On December 27, 1806, the General Assembly approved "an act to establish a state bank." The bank was "to be denominated the

Bank of Kentucky," located in Frankfort "but in case of a removal of the seat of government, the bank may be removed therewith."

The capital stock of the bank "shall consist of 1,000,000 dollars" divided into 10,000 shares of 100 dollars each. The state

of Kentucky would possess 5,000 shares. Of the remaining 5,000 shares, 3,000 would be offered for subscription at nine Kentucky

cities—Lexington, Paris, Washington, Richmond, Louisville, Bardstown, Danville, Shelbyville, and Frankfort—by agents named in

the act. The remaining 2,000 shares "shall be subscribed for in such manner and at such times as shall be ordained by the

president and directors of the bank."

The bank was to be governed by a president and twelve directors. Six of the directors would be chosen annually by the stockholders

at an annual meeting. The remaining six directors and the president would be elected "on the part of the state by a joint vote of

the senate and house of representatives." The legislature had the power to increase the number of directors to a maximum of twenty-four.

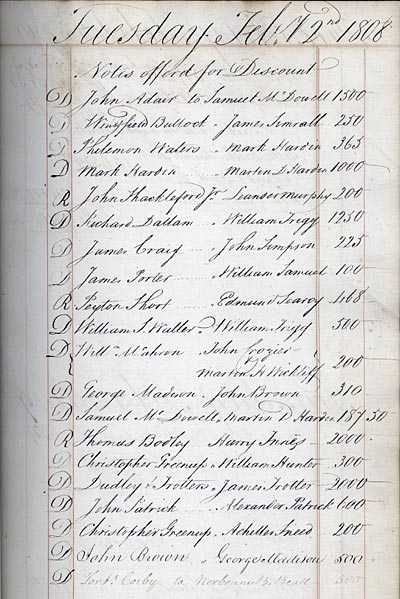

Page from the Bank of Kentucky Ledger, 1807-1810, Kentucky Historical Society Collections. The Bank of Kentucky, modeled on the Bank of the United States, was chartered as part of a compromise that ended the controversy over private banking. Robert Alexander of Versailles was elected president in 1807 and served for fourteen years during which the bank was sound, profitable, and conservatively administered. The bank's charter was repealed in 1822 by a hard-money legislature after the newly chartered Bank of the Commonwealth flooded the state with its own currency.