LRC News Releases

Senate committee advances bill to deter abuse of a corpse

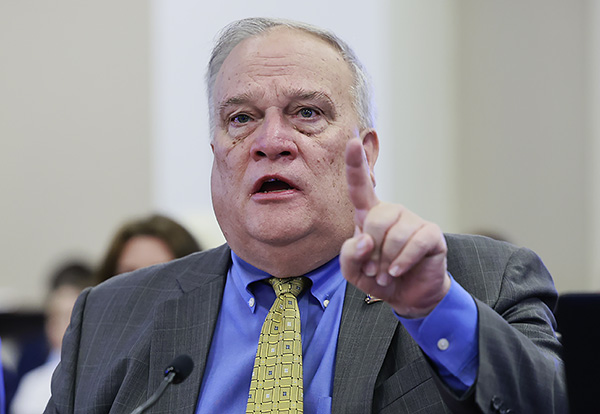

Committee Chair Sen. Brandon J. Storm, R-London, testifies Thursday on Senate Bill 221 during a Senate Judiciary Committee meeting. A high-res version is available here.

FRANKFORT — Legislation seeking to strengthen Kentucky law against abuse of a corpse advanced unanimously Thursday during a Senate Judiciary Committee meeting.

Senate Bill 221 would make clear that knowingly purchasing, selling, transferring or offering to purchase, sell or transfer a corpse or part of one after the corpse has been authorized for cremation or burial would be a class D felony in the commonwealth.

Committee Chair Brandon J. Storm, R-London, is sponsoring the bill. He pointed to news stories about body parts being harvested and sold inappropriately and illegally because the decedent didn’t consent to have their body parts used for scientific study or other purposes.

When individuals do not consent to have their body parts studied, “this would prohibit individuals from selling those body parts, and there’s been numerous cases throughout the United States,” Storm said.

Storm pointed to a 2023 case in Little Rock, Ark. involving federal charges stemming from the interstate sale of human remains.

Sen. Michael J. Nemes, R-Shepherdsville, asked if it isn’t already against the law to “sell something you don’t own.”

Storm said it should be. The bill provides a cautionary approach in case the question is raised when someone dies, he said.

Sen. Phillip Wheeler, R-Pikeville, said his father once purchased a medical practice that was in possession of human skulls. He asked if the proposed legislation would make it a felony to transfer such items when the source is unknown and the items have become more like historical objects.

“I don’t know if we would potentially – unintentionally – create a felon by a circumstance like that,” Wheeler said.

Storm said that situation is different than one involving a corpse or parts of a corpse that have been scheduled for final disposition through burial or cremation.

“I think in your situation it refers to a relic of the past, perhaps, and this would be referring to individuals who were authorized for final disposition through cremation or burial. So, we’re trying to make sure we’ve very tight on that,” he said.

Sen. Aaron Reed, R-Shelbyville, asked how the bill relates to a fetus being aborted or any other reason of death.

“Would this also pertain to that?” he said.

Storm said the case in Arkansas involved the sale of varying types of organs and other body parts and the intention of the bill is to ensure corpses aren’t abused in Kentucky.

“What we’re trying to make sure is that that’s not occurring here in the commonwealth. But your question is an excellent question,” he said. “If, I think, it had been authorized for final dispositions or cremation or burial, very likely that would qualify under this statute,” he said.

The bill now heads to the full Senate for consideration.

Committee advances bill to strengthen research innovation

Senate President Robert Stivers, R-Manchester, speaks on Senate Bill 6 during Wednesday’s meeting of the Senate Appropriations and Revenue Committee. A high-res version is available here.

FRANKFORT — Legislation aimed at boosting research collaboration and innovation across Kentucky passed the Senate Appropriations and Revenue Committee on Wednesday.

Senate Bill 6 would appropriate $150 million in general fund dollars in fiscal year 2026–27 to the Endowment Research Fund.

Senate President Robert Stivers, R-Manchester, said the proposal would establish a competitive grant process requiring collaboration among universities and encouraging institutions to work together rather than compete against one another.

“We want our athletes to compete on the field or on the court. But in the realm of research and academics, I think it’s better to collaborate and work together than it is to be in competition,” Stivers said.

The measure would allow time to develop regulations outlining priority research areas, application procedures and expectations for bringing innovations to market. Stivers said the investment is intended to help Kentucky monetize research through patents and intellectual property protections while attracting private-sector partners.

“It’s about bringing as many assets and resources as you can to the table,” he said.

Committee discussion centered on the fiscal impact and how the state’s investment could leverage additional funding and generate economic growth.

Senate Democratic Floor Leader Gerald A. Neal, D-Louisville, called the measure “a no-brainer,” and asked how the state could use the funding to attract federal dollars and other outside resources.

Stivers responded that the goal is to create a foundation strong enough to compete for major federal grants and private-sector partnerships once the state’s initial funding period ends.

Sen. Shelley Funke Frommeyer, R-Alexandria, raised questions about coordination with economic development efforts, noting Kentucky’s distinct regional strengths and asking how the state economic development cabinet might be involved.

Stivers said the cabinet supports the concept. He added that research investment often leads to job creation when companies partner with universities to develop and commercialize new technologies.

Stivers pointed to the Kentucky Spine and Brain Injury Research Trust to illustrate how long-term investment can pay off.

He referenced actor Christopher Reeve, who suffered a spinal cord injury and sought treatment in Kentucky, noting that research here into tissue regeneration and neurological recovery continues to make advancements in modern medicine.

Stivers said those early investments laid the groundwork for continued innovation, allowing Kentucky institutions to secure competitive grants and build partnerships, explore tissue impacts from space travel, and connect those findings with research into Alzheimer’s disease.

Neal echoed that sentiment.

“When you envision something and you invest in it, we can get an outcome we didn’t expect to happen,” Neal said during the discussion.

The bill passed committee 19-0 and now heads to the full Senate for consideration.

Senate committee OKs resolution to address physician shortages

Senate President Robert Stivers, R-Manchester, testifies on Senate Joint Resolution 116 during Wednesday’s Senate Health Services Committee meeting. A high-res version is available here.

FRANKFORT — The Senate Health Services Committee unanimously advanced a joint resolution Wednesday designed to help address physician shortages in Kentucky.

The measure, Senate Joint Resolution 116, would direct the University of Kentucky, the University of Louisville and Eastern Kentucky University to work together in meaningful ways to alleviate physician shortages in underserved areas of the state.

Senate President Robert Stivers, R-Manchester, is sponsoring the resolution. He said it would call on the universities to look at the issue over the next year and “come back with a good framework and plan on how we serve the full state of Kentucky with health care.”

Stivers said it’s hoped that other entities – such as the University of Pikeville, the Kentucky Hospital Association and the Kentucky Medical Association will join the effort to help find solutions to the physician shortages.

The resolution calls for the three universities to develop a report and submit it to the general assembly by Jan. 1, 2027. Some topics expected to be in the report are: the shortage of primary and specialty care physicians, retention of physicians, possibilities for building on current actions, and regulatory or statutory barriers.

The resolution would earmark $250,000 from the general fund in fiscal year 2026-2027 to administer and produce the report.

Committee Chair Sen. Stephen Meredith, R-Leitchfield, asked Stivers what those at the universities initially thought of their proposed undertaking.

Stivers said he has spoken with medical officials at the UofL and EKU, and their reaction was positive; they want to move forward and feel comfortable in the collaboration.

Meredith pointed to data regarding physician shortages throughout the United States and said Kentucky’s shortage is not as severe as some other states’ shortages. “One of the issues may be the maldistribution of physicians, and that’s something that certainly has to be factored in,” he said.

Sen. Donald Douglas, R-Nicholasville, who is a physician, said the health care space is changing and Kentucky must keep pace.

“I appreciate the continued movement to direct our universities to work together in coordination with one another, allowing them to step outside the silos to better serve the people of the commonwealth,” he said.

Stivers said Manchester benefits from an Adventist hospital because not only does it provide health care, it also invests money in the community and provides hundreds of jobs.

“Thinking of the health care that we have access to, that very, very few small towns have, is wonderful. But then thinking of the economic engine that it is for my hometown is really quite unbelievable,” he said.

Sen. Karen Berg, D-Louisville, who is a physician, described the resolution as “awesome.” She said it’s the responsibility of the state’s physicians to help address the shortage problem.

“I hear and I hear and I hear about shortages of physicians in this state and how we need to basically alter requirements for who’s doing what because we don’t have enough doctors. And so, we’re having to rely on mid-level providers,” she said.

Sen. Keturah J. Herron, D-Louisville, also said she supports the resolution.

“Yesterday, I spoke to the folks at Eastern Kentucky University, and one of their ‘asks’ is also expanding their medical education programs, and so I completely support this,” she said.

Joint resolutions have the effect of law and are treated procedurally as bills. SJR 116 now moves to the full Senate.

House bill clarifying traceable communications law advances

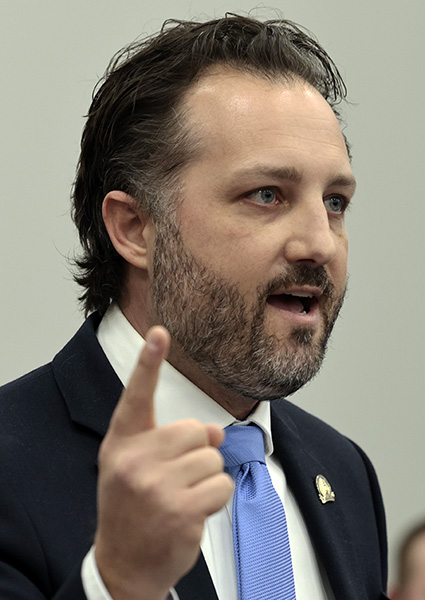

Rep. J.T. Payne, R-Henderson, said House Bill 67 would provide clarifications to Kentucky’s traceable communications law during Wednesday’s House Primary and Secondary Education meeting. A high-res version is available here.

FRANKFORT — A bill seeking to clarify a law designed to provide oversight on communications between students and public school faculty and staff is on the move.

House Bill 67, sponsored by Rep. J.T. Payne, R-Henderson, received unanimous approval from the House Primary and Secondary Education Committee on Wednesday. Payne said the legislation builds on Senate Bill 181 from the 2025 legislative session.

“Senate Bill 181 is a very well-intentioned piece of legislation that maybe had some unintended consequences,” Payne said. “Our goal in this bill, House Bill 67, is to clean up that the best we can to still protect our students, but also not to make it more difficult for teachers to do their job and be the professionals that they are.”

SB 181 required public school districts to establish a traceable electronic communications system between students and teachers and other school authority figures to provide oversight and establish boundaries.

The current law does provide a few exceptions as to who is required to communicate with a student via traceable communications. A parent teaching at the same school as their child, for example, is exempted from exclusively using traceable communications with their own child under current law.

HB 67 would expand the list of individuals exempted from using traceable communications and provide other clarifications, Payne said.

Under the legislation, cousins would be added to the list of exempted family members as well as any adult who lives in the same household as the student.

A group text involving two or more school employees or qualified volunteers and one or more students for an academic, athletic or extracurricular purpose is also among the new exemptions listed in the legislation.

Payne said HB 67 would also better define a qualified school volunteer.

Additionally, Payne told the committee that teachers who may encounter students via other jobs outside the school system, like a youth pastor, delivery driver or a photographer, may disclose that job and be exempt from using a traceable communication system for those purposes under the bill.

In case of an emergency, HB 67 would allow a teacher to respond to a student outside of the traceable communications system.

“They can help that student and then disclose that communication afterward and be perfectly ok,” Payne said. “Then it also says that as part of a field trip or work-based learning experience, teachers can contact students.”

HB 67 would also further clarify which social media communications are exempt, Payne said.

“House Bill 67 clarifies and says no, if it’s a public post or public comment and not a private one then it is ok,” he said.

Rep. Timmy Truett, R-McKee, is an educator and a youth leader at his church. He asked if he would be able to contact his youth group about events at church without notifying his school.

Payne said yes, as long as he discloses the job.

“You say I’m a youth pastor at such and such church, then yes. That would allow you to have those communications,” he said.

Rep. Lisa Willner, D-Louisville, thanked Payne for the legislation. She asked Payne who he consulted with when drafting the bill.

Payne said he met with the Kentucky School Boards Association, Kentucky Association of School Administrators, Kentucky Department of Education, Kentucky League of Cities, Kentucky Farm Bureau and more while drafting HB 67.

HB 67 is now before the full House for consideration.

This Week at the State Capitol (2-27-26)

Lawmakers spent the eighth week of the 2026 legislative session moving bills on Medicaid reform, educational tax credits and a new two-year spending plan for the state executive branch. A high-res version is available here.

FRANKFORT — Major bills on Medicaid reform, educational tax credits and the state’s new budget plan dominated much of the action in the Kentucky General Assembly this week as lawmakers debated some of the biggest spending and policy decisions of the session so far.

Legislators have continued to ramp up the pace each week since convening in January, and the intensity reached a new peak on Friday when lawmakers were simultaneously advancing House Bill 2 off the House floor and giving final passage to House Bill 1 in the Senate.

Both bills arrive in the wake of the One Big Beautiful Bill Act that the U.S. Congress passed last year.

HB 2 seeks to align Kentucky’s Medicaid program with the new federal law, and among many provisions, would implement community engagement requirements for certain able-bodied adults.

Other sections of the wide-ranging bill would address cost-sharing, eligibility reviews, non-emergency transportation services, accountability for managed care organizations and delivery of dental services. HB 2 also aims to enhance transparency by creating a performance dashboard and requiring regular program audits.

The legislation won support from the House Appropriations and Revenue Committee on Tuesday and cleared the House on a 77-21 vote Friday after supporters fended off a half-dozen amendments that were called on the chamber floor.

Proponents say the measure would streamline operations, improve outcomes, combat fraud and ensure that the program prioritizes those Kentuckians who most need services.

But during more than an hour of impassioned debate, critics charged that HB 2 would reduce access to health care and create steep, bureaucratic barriers for struggling Kentuckians.

The bill now heads to the Senate, which held an hour-long debate on the floor Friday over HB 1. That legislation would clear the way for Kentucky to participate in the new federal educational tax credi t program established in the One Big Beautiful Bill.

The program allows taxpayers to contribute up to $1,700 to scholarship organizations that assist K-12 students in public and private schools. Families can use the funds for a wide range of education-related expenses, and taxpayers would receive a matching federal tax credit for contributions.

Advocates for the bill say it will boost support for low-income students and students with special needs, but opponents have raised concerns that it will exacerbate disparities in education.

HB 1 advanced out of the House Appropriations and Revenue Committee and off the House floor on Tuesday. The Senate voted 33-5 on Friday to send the bill to the governor’s desk.

Perhaps the most watched bill of the week was House Bill 500, which represents the House version of the executive branch budget. It includes more than $151 billion in proposed appropriations for the 2026-28 biennium, including operating and capital costs.

Lawmakers sparred for more than two hours on the House floor Thursday before passing the bill 81-18 along with another measure that proposes a two-year spending plan for the judicial branch.

HB 500 seeks an overall reduction in spending but exempts areas like veterans affairs, the state funding formula for schools known as SEEK, Medicaid benefits, behavioral health, juvenile justice, corrections, and other key areas.

Backers said HB 500 would prioritize needs over wants and limit the growth in state spending to around 2% each year. Detractors said the plan should include more funds for education, housing and Medicaid, among other areas.

The bill now heads to the Senate where it is sure to undergo changes.

The general assembly has now convened for 36 days of this year’s 60-day session, and more than 1,000 bills have been filed in the chambers so far.

But lawmakers are facing deadlines next week for introducing new legislation: Monday is the last day to file bills in the Senate, and Wednesday is the last day in the House.

Meanwhile, dozens of other bills are continuing to build momentum. Here’s a look at some of the other measures that were moving forward this week:

Impaired Boating – In the event of a serious boating accident, House Bill 168, known as Keegan’s Law, would require law enforcement officers to seek a search warrant for blood testing of the boat operator if that person refuses to submit to the test. It also calls on telecommunicators to report boating accidents to Kentucky State Police. The measure cleared the House on Monday.

Involuntary Commitments – House Bill 249 would expand the list of felony sex crimes for which a judge may involuntarily commit a mentally incompetent offender to treatment. The House voted in favor of the legislation Monday.

Artificial Intelligence – House Bill 455 would forbid the use of artificial intelligence in providing direct mental health therapies. AI could not be used to make independent therapeutic decisions, to directly interact with clients or to generate treatment plans without the review and approval of a licensed professional. The House passed the bill Monday.

School Employee Sick Leave – Under Senate Bill 124, school districts would have the option to let employees voluntarily cash in sick days. Employees would need to maintain a minimum of 15 sick days, but could cash in additional days at 30% of their current pay rate. The bill would also allow teachers to use sick days for religious holidays that do not appear on the school calendar. The Senate gave the bill a green light on Monday.

Dolly Parton’s Imagination Library – Senate Joint Resolution 54 calls on the Kentucky Department of Libraries and Archives and the state Cabinet for Health and Family Services to cooperate in exploring ways to increase enrollment in Dolly Parton’s Imagination Library. The measure cleared the Senate Families and Children Committee on Tuesday.

Child Protection – House Bill 246 would require animal control officers to complete training to help recognize signs of child abuse and neglect. The House Local Government passed the bill Tuesday.

Firearms Conversation Devices – House Bill 299 would align Kentucky gun laws with federal law related to machine gun conversion devices. Federal law already bans possession of such devices, but supporters say the bill is needed to help law enforcement enforce the ban locally. Ultimately, possession of a conversation device would be a class C felony in Kentucky if the bill becomes law. The legislation received support from the House Veterans, Military Affairs and Public Protection Committee on Tuesday.

Logan’s Law – House Bill 422 would clarify the insanity defense in state criminal law and eliminate the eligibility of some violent offenders for early release. The bill was filed after Ronald Exantus, the man who killed 6-year-old Logan Tipton in 2015, was released early from prison last year. The House approved the measure Tuesday.

Student Violence – Senate Bill 101 would mandate that local boards of education expel students for a minimum of 12 months when they become aware of an incident in which a student in grades 6–12 intentionally harmed a teacher or other school employee on school grounds or at a school function. The Senate voted for the measure Tuesday.

FAIR Teams – Senate Bill 162 would eliminate the requirement to use Family Accountability, Intervention and Response teams – known as FAIR teams – in the diversion process for juvenile offenders in Kentucky. The bill won support in the Senate on Tuesday.

Status Offenders – Senate Bill 170 would create a four-year pilot program in up to 10 school districts to help address barriers to school attendance and improve accountability among parents of habitually truant students. SB 170 cleared the Senate Tuesday.

Physician Residencies – Senate Bill 137 would eliminate a duplicative residency requirement for international doctors to practice in the state. The Senate Health Services Committee passed the bill Wednesday.

Deer Populations – House Bill 142 seeks to help farmers more easily file and renew claims for crop and property damage caused by deer while also addressing overpopulation concerns across the state. The House Agriculture Committee advanced the bill Wednesday.

School Board Candidates – House Bill 469 would require candidates for local school board seats to undergo background checks. The House Primary and Secondary Education Committee voted for the bill Wednesday.

Sunscreen in Schools – House Bill 586 clarifies that sunscreen is not a medication and ensures that students can apply sunscreen at school without a written order from a health care provider. The legislation cleared the House Primary and Secondary Education Committee on Wednesday.

Residential Storm Shelters – Senate Bill 11 would create a residential safe room rebate fund that helps homeowners pay for building emergency storm shelters. The goal is to eventually provide matching grants to help cover the cost. The Senate Appropriations and Revenue Committee passed the bill Wednesday.

Nuclear Energy – Senate Bill 57 would create the Nuclear Reactors Site Readiness Pilot Program to help energy providers obtain licenses and permits related to constructing nuclear power projects. The program would provide grant funding for up to three projects with up to $25 million in grants available for each one. The legislation received support from the Senate Appropriations and Revenue Committee on Wednesday.

Juvenile Justice – Senate Bill 125 would establish a comprehensive framework for identifying and treating high-acuity youth in Kentucky's juvenile justice system and create a dedicated mental health residential treatment facility for them. The Senate Appropriations and Revenue Committee gave the bill a green light Wednesday.

Kindergarten Readiness – Senate Bill 191 calls on the University of Kentucky to establish a pilot program that gauges the effectiveness of using financial incentives to encourage kindergarten readiness. SB 191 cleared the Senate Appropriations and Revenue Committee on Wednesday.

Environmental Regulations – Under Senate Bill 178, new state environmental regulations cannot be more stringent than federal laws or regulations regarding the same topic. In absence of a federal law or regulation, new state environmental regulations must be technologically achievable and based upon the best available science and the weight of scientific evidence. The Senate Natural Resources and Energy Committee passed the measure Wednesday.

Prison Education Programs – House Bill 5 would establish the Kentucky Community and Technical College System Prison Education Program, seeking to reduce recidivism and support workforce development. KCTCS would partner with the state Department of Corrections to build and operate a vocational training campus at Northpoint Training Center. The legislation received a nod from the House Judiciary Committee on Wednesday.

Diabetes – House Bill 141 calls on the Kentucky Department of Education to provide informational materials on Type 1 diabetes to school districts for distribution to parents and students. The House voted in favor of the bill Wednesday.

Organ Donors – House Bill 510 aims to protect patients during the organ donation process by requiring additional verification steps before organ procurement can begin. It would also clarify that donor consent must be properly documented and that a patient must be formally declared dead before organs are donated. The bill cleared the House on Wednesday.

Stalking – House Bill 521 seeks to modernize state stalking laws especially regarding stalking behaviors that occur through electronic communications and social media platforms. The legislation won support in the House on Wednesday.

Alternative Sentencing – Senate Bill 122 aims to keep families intact when a parent is convicted of a felony. It would require Kentucky courts to consider alternative sentences for certain nonviolent felony convictions when the defendant is a primary caretaker of a dependent child. The Senate voted for the measure Wednesday.

Child Marriage – Senate Bill 156 would close a loophole in state law to ensure that 18 is the legal age for marriage in Kentucky. Right now, state law still allows 17-year-olds to get married if they have approval from the judicial system. The Senate Committee on Veterans, Military Affairs and Public Protection moved the bill forward on Thursday.

Data Centers – House Bill 593 seeks to protect utility ratepayers from subsidizing the energy costs for new data centers. It calls on tech companies, when opening a data center, to either generate their own energy, enter into a power purchase agreement or purchase power on the national market. The legislation cleared the House Committee on Economic Development and Workforce Investment on Thursday.

Wrongful Conviction Compensation – Senate Bill 131 would allow wrongfully convicted felons in Kentucky to sue for monetary damages based on how long they were wrongfully imprisoned. The Senate Judiciary Committee voted for the bill Thursday.

Medicaid Delivery Study – Senate Concurrent Resolution 9 calls for a study of accountable care models used for Medicaid programs in other states. The study would also look at opportunities to implement such a model in Kentucky through a pilot program. The effort seeks to control costs and improve health outcomes. The House Health Services Committee approved the resolution on Thursday.

Food is Medicine Initiatives – Senate Joint Resolution 23 would declare Kentucky as a “Food is Medicine” state and direct state agencies to advance Food is Medicine initiatives. The resolution on Thursday cleared the House Health Services Committee.

State Dog Breed – Senate Bill 37 would designate the Treeing Walker Coonhound as the official state dog of Kentucky. The Senate Agriculture Committee passed the bill Tuesday, and the measure cleared the Senate floor on Friday.

Recovery Residences – Senate Bill 33 seeks to enhance local communication and transparency around residential recovery centers. Operators who want to open a center would have to notify city government within 30 days of applying and provide a second notice if the center is certified. Operators would also be required to notify the city if any fines are imposed on the facility. The bill also would allow cities to maintain a registry of residential recovery centers. SB 33 advanced off the Senate floor on Friday.

Lawmakers are scheduled to reconvene on Monday for day 37 of the session.

Kentuckians are urged to check the general assembly's calendar for updates. Kentuckians can track the action through the Legislative Record Webpage, which allows users to read bills and follow their progression through the chambers.

Citizens can also share their views on issues with lawmakers by calling the general assembly's toll-free message line at 1-800-372-7181.

House passes Medicaid reform bill

Rep. Ken Fleming, R-Louisville, speaks on the Kentucky Medicaid Reform Act found in House Bill 2 on the House floor on Friday. A high-res version is available here.

FRANKFORT — A major overhaul to Kentucky’s Medicaid program is on the move in the Kentucky General Assembly.

The Kentucky House of Representatives passed House Bill 2 on Friday after nearly two hours of debate.

Rep. Ken Fleming, R-Louisville, is the primary sponsor of the legislation. He said the first nine sections of HB 2 would bring state Medicaid law in line with the House Resolution 1, or the One Big Beautiful Bill Act, that U.S. Congress passed last year.

“The federal government has shifted the financial burden of Medicaid to Kentucky,” he said, adding that Medicaid coverage for a third of Kentuckians is the second largest state expense.

In addition to implementing new federal law, the Kentucky Medicaid Reform Act also aims to implement recommendations from the state Medicaid Oversight and Advisory Board.

This includes enhancing transparency, bettering health outcomes, streamlining program operations and delivery, strengthening program oversight and accountability, and reducing fraud, Fleming said.

The HR 1 provisions of the bill would address new federal community engagement, cost sharing and eligibility requirements.

Fleming said the general assembly’s response to HR 1 would focus on the Medicaid expansion population and not the traditional recipients. There are also specific carve outs to exempt certain members of the Medicaid population.

“These populations include pregnant women, caregivers for a dependent child under 13, and individuals with serious and chronic health conditions,” Fleming said.

Children and individuals on community-based waivers would also be exempt.

Fleming said HB 2 promotes personal responsibility without limiting access to essential care.

“It increases eligibility integrity by implementing safeguards to ensure only eligible Kentuckians are enrolled in our Medicaid program,” Fleming said.

Other provisions of HB 2 include reforming the appeals and auditing process, limiting coverage for glp-1 weight loss medication to medical-necessity only, and requiring the state auditor to conduct an audit of the program at least once every five years, Fleming said.

Critical debate of HB 2 included concerns the bill will result in less Kentuckians in need receiving care and put an undue burden on those subjected to the cost sharing and community engagement requirements.

Rep. Adam Moore, D-Lexington, said he is in support of the bill’s goal to reduce fraud and ensure recipients are seeing their primary care physicians more and going to the emergency department less.

He said he does, however, still have concerns about the cost sharing requirements of the legislation going beyond the federal requirements.

“We all share a goal of ensuring that the long-term sustainability of our Medicaid program, but we need to be careful that in our pursuit of oversight that we don’t actually build a pay-to-play health care system that punishes or leaves out Kentuckians that this program was designed to protect,” Moore said.

Fleming said the $20 copay provision of HB 2 would not go into effect until Oct. 1, 2028. If HB 2 becomes law, the Medicaid Oversight and Advisory Board would do a study.

“If we find through that data, through surveys, through whatever information we get that it’s not prudent to do this, we have two sessions before this takes effect to react to that,” Fleming said.

HB 2 now heads to the Senate after a 77-21 House vote.

Senate passes bill on federal education tax credit program

Senate President Pro Tempore David P. Givens, R-Greensburg, speaks on House Bill 1, on the Senate floor. A high-res version is available here.

FRANKFORT — Legislation implementing a new federal tax-credit scholarship program in Kentucky received final passage in the Senate on Friday and now heads to the governor’s desk.

HB 1 is sponsored Rep. Kimberly Poore Moser, R-Taylor Mill, and was carried in the Senate by President Pro Tempore David P. Givens, R-Greensburg.

It would make Kentucky eligible to participate in the qualified elementary and secondary education scholarship federal tax credit program established in House Resolution 1, which passed the U.S. Congress last year.

The legislation grants Kentucky’s Secretary of State the authority to opt into the program on behalf of the state. Participants would receive a federal tax credit of up to $1,700 for donations made to Kentucky scholarship granting organizations (SGOs).

“I want to stress the word tax credit, Mr. President, because that is a significantly different phrase than tax deduction. This is a dollar-for-dollar credit. In essence, if you have a dollar that you owe to D.C., you have the choice of sending that dollar to D.C. or one of these Kentucky SGO’s,” Givens said.

Givens also said that potential donations from the bill would not affect state resources in any negative fashion.

“Your donations do not impact state receipts in any fashion other than potentially having a positive ripple multiplier effect of that money being invested back in Kentucky. There are no state tax dollars being used in this program,” Givens said.

Senate Minority Caucus Chair Reginald L. Thomas, D-Lexington, spoke against the bill, arguing that as a tax credit, it would divert important government money that could otherwise fund other programs.

“As explained, this bill is a tax credit that takes out money that could otherwise go to Medicaid benefits, Medicare benefits, SNAP, defense, housing, transportation, you name it,” Thomas said.

Thomas further argued that the bill might create a two-tiered public school system.

“This bill will create a have and have not system among our public schools. Certainly those schools that are in urban areas, that have private schools, this will be a real boon for them,” Thomas said. “But if you live in one of those counties where your primary workforce depends on the school system, you will be harmed and disadvantaged by this bill.”

Speaking in favor, Senate Majority Floor Leader Max Wise, R-Campbellsville, said the bill would help provide the best outcomes for Kentucky students.

“This is truly a benefit that would help kids. The creativity and opportunity this could provide for summer programs, for the purchase of technology. This is another tool and another option for superintendents to work with,” Wise said.

Sen. Robin L. Webb, R-Grayson, explained her yes vote by saying she would monitor how any increased funding is used in the state to ensure the bill achieves its intended effect.

“This is an opt-in program. I assume we could also opt-out if it does not give us the results that we think it will or that other states are experiencing. I’m a rural legislator, we are going to be monitoring that. I think this bill has a lot of potential across the board.”

State budget clears House floor, heads to the Senate

Rep. Josh Bray, R-Mount Vernon, speaks on House Bill 500 on the House floor on Thursday. The bill is a first draft of the state budget for the next two years. A high-res version is available here.

FRANKFORT — Two bills related to Kentucky’s spending plan for the next biennium advanced off the Kentucky House floor on Thursday.

House Bill 500 would appropriate billions each fiscal year to the state executive branch. Rep. Jason Petrie, R-Elkton, serves as the committee chair for the House Appropriations and Revenue Committee. He was joined by the chairs for the House Budget Review Subcommittees in presenting on HB 500 on the House floor.

In his opening remarks, Petrie said the legislation is a “good first draft” as the general assembly moves through the lengthy budget drafting process.

“We focused on the near-term needs for the next two years,” Petrie said. “And I stress, we focused on the needs, not wants.”

State government offices and agencies and other stakeholders have spent the last several weeks meeting with Petrie and the budget subcommittee chairs to share what the spending needs are in Kentucky over the next two years, he said.

“We focused on the needs. And ultimately, we ended up at …a restrained growth of spending in each year of a little less than 2%,” Petrie said.

While the budget calls for an overall reduction in spending, Petrie said there are areas of the budget that are exempt. Those are: veterans affairs, SEEK, county costs, Medicaid benefits, behavioral health, family resource centers, youth service centers, juvenile justice, corrections, community services and local facilities.

A previous call to limit spending on the state employee health insurance plan was removed, according to the bill.

Looking at projected revenues, Petrie said HB 500 calls for 2% of revenues from each year to be deposited into the budget reserve trust fund. He projects that would result in about a $614 million allocation to address long-term needs in the future.

The House debated HB 500 for more than two hours Thursday afternoon, during which several lawmakers called for an increase in funding for public education, affordable housing, Medicaid and more.

Rep. Kim Banta, R-Fort Mitchell, serves as the chair of the House Budget Review Subcommittee on Primary and Secondary Education. She said the budget calls for a 2% increase in SEEK, or per pupil spending, in each fiscal year.

Rep. Adrielle Camuel, D-Lexington, said she is thankful for the budgeted increase in SEEK funding, but feels it doesn’t go far enough.

“Those increases are welcome, but they’re just not enough to keep up with the rising cost and the growing expectations that we keep putting on our public schools and our school staff,” she said.

Camuel called for a floor amendment that would provide a salary increase for public school teachers and support staff, but the amendment failed.

“If we truly value public education, then our budgets have to reflect that,” she said.

Rep. Josh Bray, R-Mount Vernon, serves as a vice chair of the House Appropriations and Revenue Committee. He said he would also like to see more funding for education and other things, but Kentucky must “live within its means.”

“I trust you all when you say you want these things, because guess what – we want them too. But there are things we can afford to do, things we need to do in order to move the commonwealth forward,” Bray said, adding the state can’t afford reckless spending.

The House passed HB 500 by an 81-18 vote.

House Bill 504 – the state judicial branch budget – also advanced off the House floor on Thursday after receiving a 94-4 vote.

Rep. Stephanie Dietz, R-Edgewood, also described the judicial bill as a “good first draft” that supports infrastructure needs, flood recovery, workforce stability and more.

Both HB 500 and 504 are now before the Senate for consideration.

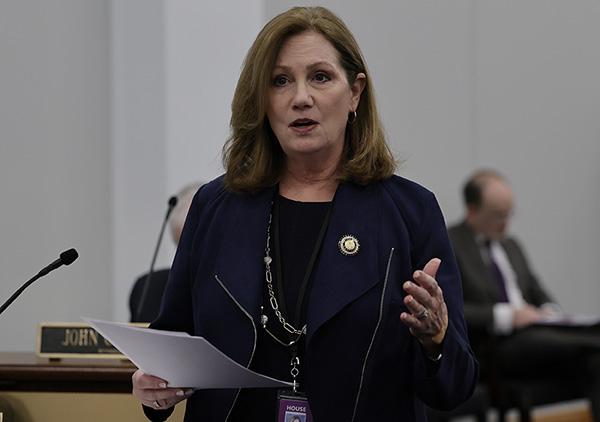

Committee approves bill to prevent child marriage

Sen. Julie Raque Adams, R-Louisville, testifies Thursday on Senate Bill 156 to the Senate Veterans, Military Affairs and Public Protection Committee. A high-resolution photo can be found here.

FRANKFORT — A bill crafted to close a marriage age loophole in Kentucky law advanced unanimously Thursday during a Senate Veterans, Military Affairs and Public Protection Committee meeting.

“Basically, this is just legislation designed to end child marriage in Kentucky once and for all by closing the remaining loopholes and ensuring that our laws are clear, enforceable and centered on the safety and dignity of our minors,” said the bill’s sponsor, Sen. Julie Raque Adams, R-Louisville.

The measure – Senate Bill 156 – builds on legislation the Kentucky General Assembly passed in 2018, which essentially identified 18 as the legal age for marriage. However, the law still allowed 17-year-olds to get married if they had approval from the judicial system, Adams said.

“It was kind of a checklist that they would go through. The main one being that that 17-year-olds would be emancipated, so in case anything happened, they would have full legal rights to sign a lease or enter into a domestic violence shelter, those kinds of things,” she said.

The caveat has been exploited and not adhered to, Adams said.

Donna Simmons, founder of the REVIVE Collective and survivor of generational child marriage, testified that she reached out to Adams after years of trauma.

“I approached Senator Adams about filing this bill because this is not theoretical to me. This is my life. My mother was a resident of McCreary County when she was 13 years old and married my father. He was a grown man who had already served in the Korean War and had two young sons,” she said.

Simmons said when she was 14 years old, she was admitted to a behavioral health facility where she was groomed by a 29-year-old staff member.

“When I was released, that relationship continued, and at sixteen, my mother consented to me marrying him. He was 31. I was forced to drop out of high school before completing the tenth grade,” she said. “When I tried to escape his abuse, I was denied housing because I was a minor and I could not enter into a contract.”

Simmons said she was also turned away from a domestic violence shelter because she was under age.

“At sixteen, I miscarried and nearly died from complications. As a married minor, I could not consent to my own medical care. I had to wait for my abuser to decide whether I would receive treatment. I became pregnant again when I was 17. My daughter was born just about a month after I turned 18,” she said

Simmons said when she was choked by her husband, she knew things had to change, and now after surviving violence, exploitation, and systemic failure, she works to protect other girls from becoming trapped.

Simmons testified she had to fight to obtain public records and discovered some officials were violating child marriage laws by authorizing marriages involving 16-year-olds, clerks bypassing required judicial orders and marriages involving age gaps of 10-12 years receiving approval.

“Let us stop interrupting childhood in the name of marriage and give children full lives that they not have to spend decades recovering from,” she said.

Committee Chair Sen. Matthew Deneen, R-Elizabethtown, thanked Simmons for testifying.

“I know many folks may think this is an issue that doesn’t have so many layers, but it does. And we appreciate you sharing your story with us.”

Sen. Gary Boswell, R-Owensboro, said Simmons has a heartbreaking story and said he was sorry she went through it. He voted for the bill, but said he still has some questions.

“My best friend and his wife, they were married when she was 17 and he’s 19. They’ve been married 60 some odd years, and so, I understand the issue when it comes to predators and all that,” he said. “…I’m going to be in favor of the bill, but I do have a few questions and maybe we can talk about later.”

Sen. Brandon Smith, R-Hazard, said Simmons spoke on behalf of other women who might not be able to come forward regarding their situations. He said Kentucky is “only as strong as the least of us” and told Simmons she is part of something historic and is a tenacious fighter after being turned away from institutions she thought would help her.

“But I’m glad you didn’t stop, and I apologize on behalf of all those agencies and institutions that turned you away and let you down,” he said. “But you deserve to hear that apology from somebody in government that says to you that I’m truly sorry they let you down.”

Bill advances on compensation for wrongfully convicted felons

Sen. Robin L. Webb, R-Grayson, testifies on SB 131 at Thursday’s meeting of the Senate Judiciary Committee. A high-resolution photo can be found here.

FRANKFORT — Legislation that would create a new civil cause of action for wrongfully convicted felons to obtain compensation for their lost years advanced out of the Senate Judiciary Committee on Thursday.

Senate Bill 131, sponsored by Sen. Robin L. Webb, R-Grayson, creates new statutory language that allows wrongfully convicted Kentucky felons to sue the commonwealth for monetary damages based on how long they were wrongfully imprisoned.

“There have been 23 known exonerations since 1989, with innocent Kentuckians losing a combined 220 years of their lives,” Webb said. “What I think we have done with this bill is try to narrowly define who would be eligible and provide a rational system for their compensation.”

As laid out in the bill, this new civil cause of action would apply only to incarcerated individuals who have had their felony convictions reversed, in addition to those who, meeting the incarceration requirement, have received an unconditional gubernatorial pardon on innocence grounds.

Michael VonAllmen, a wrongfully convicted individual testifying with Webb on the bill, said that the current remedies available to individuals in his situation are not enough for what their wrongful convictions have made them endure.

“When you take 27 years as a convicted felon, and the end result of your sentence being overturned is an ‘oops, we’re sorry’, that would not sit right with you, or anyone,” VonAllmen said.

Kentucky Innocence Project Director Aaron Riggs, also speaking with Webb on the bill, said that the current system provides few resources for innocent individuals once released from their wrongful imprisonments.

“Really what we have right now is a system where individuals who have gone to prison for crimes that they have committed and served their time reenter society with more support than people who have gone to prison for crimes that they have not committed,” Riggs said.

Senate Minority Caucus Chair Reginald L. Thomas, D-Lexington, speaking in favor of the bill, asked how much the claims arising out of the bill might cost.

Webb said that should every claim from existing exonerations be granted, the state would pay out $7.5 million in damages.

Sen. Michael J. Nemes, R-Shepherdsville, said that the bill was an important way the state could take accountability for incorrect judicial outcomes.

“There is no way that we can repay anyone in this situation. But what the bill shows is that we have made a mistake, and we want these people back in society as best as they can be,” Nemes said.

Sen. Phillip Wheeler, R-Pikeville, asked if this bill would prevent wrongfully convicted individuals from filing other civil claims surrounding their imprisonment.

“Would pursuing a claim under this new section preclude pursuing any other actions against negligent parties,” Wheeler asked.

Riggs answered that, while the new language would not preclude individuals from filing other claims, any damages awarded by those other claims would offset any compensation they might have received from claims made under this new bill.

SB 131 now moves to the full Senate.

Bill to regulate utilities for data centers on the move

Rep. Josh Bray, R-Mount Vernon, told the House Economic Development and Workforce Investment Committee on Thursday that House Bill 593 would protect ratepayers from subsidizing data centers. A high-resolution photo can be found here.

FRANKFORT — As tech companies plan to bring more data centers to Kentucky, House Bill 593 would ensure Kentuckians do not subsidize the utility costs.

The House Economic Development and Workforce Investment Committee heard from Rep. Josh Bray, R-Mount Vernon, on the issue on Thursday. He is the primary sponsor of the legislation.

Bray said he’s spent the last two years on the Artificial Intelligence Task Force learning about the utility needs of data centers.

“What this bill does is make sure Kentucky handles data centers the right way, so that we protect our ratepayers, and we take advantage of kind of a unique opportunity and protect our future economic interest going forward,” Bray said.

If a tech company wants to bring a data center to Kentucky, HB 593 would require the company to do one of three things, Bray said.

First, a company could choose to provide its own electric generation for a data center and sell any excess to the local utility. The second option is the company could enter into a power purchase agreement, and the third option would be purchasing the electricity on the national open market.

HB 593 would also require a minimum, nonrefundable $75,000 application fee.

“If we have to increase generation, if we have to increase transmission, then the data center should pay for all of those expenses,” Bray said.

The legislation also includes a provision addressing water, gas and wastewater costs, he said.

Rep. Nima Kulkarni, D-Louisville, who also serves as a ranking minority member on the committee, asked Bray what the application fee covers.

Bray said the fee would cover the actual cost of the study to determine the data center’s capacity and transmission requirements.

“The $75,000 application helps make sure that all of that’s paid for up front, so that ratepayers aren’t having to cover that,” he said.

The legislation would apply to municipal and private utility companies, Bray added.

Kulkarni said it is “imperative” Kentucky tries to regulate data centers to avoid negative impacts on our communities.

Rep. Kevin Jackson, R-Bowling Green, said he appreciates Bray’s work at “tackling the issue.” He wanted to know if Bray is certain this bill would protect ratepayers.

“If this bill passes, there’s no way that any constituents’ electric bills, utility bills would go up because of that,” Jackson asked.

Bray said that is his intention, and he believes the bill is “pretty clear” that ratepayers cannot subsidize data centers.

The House Economic Development and Workforce Investment Committee voted unanimously to send HB 593 to the House floor.

Rep. William Lawrence, R-Maysville, said HB 593 is a “due diligence” bill that addresses one of the biggest concerns many constituents have about data centers in Kentucky.

“I feel like we are always on the backside of fixing problems here in Frankfort, and this is a bill that gets ahead of the game,” he said. “We’re setting the parameters. We’re making the guardrails, as we should as the people who set the laws for the state.”

Bill to create KCTCS Prison Education Program advances

Rep. Jennifer Decker, R-Waddy, tells the House Judiciary Committee that House Bill 5 would reduce recidivism in Kentucky through establishing the Kentucky Community and Technical College System Prison Education Program. A high-resolution photo can be found here.

FRANKFORT — The House Judiciary Committee considered a bill on Wednesday that seeks to reduce recidivism and boost Kentucky’s workforce.

House Bill 5, sponsored by the committee’s co-chair, Rep. Jennifer Decker, R-Waddy, would establish the Kentucky Community and Technical College System Prison Education Program.

“This initiative will lower recidivism, accelerate workforce development, help address Kentucky’s labor needs, and deliver long-term security savings to society through reduced reincarceration rates,” Decker said.

Under HB 5, KCTCS would partner with the Kentucky Department of Corrections to build and operate a model vocational training campus at Northpoint Training Center, a men’s prison in Boyle County.

Decker said the legislation is modeled after a similar, successful initiative in Michigan.

“Michigan’s results are not theoretical,” she said. “They are proof that HB 5 is grounded in real world evidence and delivers a proven data-supported return on investment, safer communities, dramatically lower reincarceration rates and a stronger workforce that helps create more tax-paying citizens.”

Inmates serving a life sentence without parole or who have been convicted of a sex crime would not be eligible for the program, according to the bill. Inmates who have previously escaped prison or attempted to would also not qualify.

Kerry Harvey, a representative from the governor’s office and former secretary of Kentucky’s Justice and Public Safety Cabinet, told the committee HB 5 would not replace prosecution or punishment.

“It is not a ‘get out of jail free card,’” he said. “It will, however, turn out inmates who are substantially less likely to commit new crimes upon release from prison.”

Harvey also told the committee he is appreciative of the partnership with KCTCS President Ryan Quarles on the project.

Quarles said KCTCS’s partnership with the Department of Corrections is not new. The college system already has 550 inmates enrolled, and recently celebrated more than 3,000 inmates receiving their GED.

More than 300 employers in Kentucky will hire convicted felons, Quarles said. This means inmates should have an opportunity to find employment upon release from prison and completion of this uniquely immersive and intensive educational program, he said.

Committee Chair Rep. Daniel Elliott, R-Danville, said the inmates could study manufacturing technology, welding, carpentry, HVAC, diesel mechanic technology, electricity, computerized machining, heavy equipment operations and more.

“These are all very marketable professions that these folks will be able to go into,” Elliott said, noting the program would be in his district.

Data collection is another provision of HB 5. Rep. Nima Kulkarni, D-Louisville, asked if there was a way to add tracking of the successful employment of inmates after they’ve been released that provision.

“I think it’s really important for us to track the success of these programs,” she said.

Quarles said KCTCS would encourage that in order to show the return of investment on the project.

“Employment trends change or there might be an employment opportunity that wasn’t there in the first wave when we get started hopefully fall of next year,” he added.

Harvey said most parolees are under supervised release, so there could be a way to track employment there.

Kulkarni asked Decker if she would be open to a floor amendment. Decker said she’d discuss it.

“That sounds like a great idea,” she added.

The House Judiciary Committee approved HB 5 by a 19-1 vote. It will now go before the full House for consideration.

Prior to voting in favor of the legislation, Rep. Kimberly Poore Moser, R-Taylor Mill, encouraged the committee to support HB 5.

“I love this bill,” she said. “This is a great initiative, and it is something that is near and dear to my heart.”

Committee advances bill on the overpopulation of deer

Rep. Michael Sarge Pollock, R-Campbellsville, is sponsoring House Bill 142, which cleared the House Agriculture Committee on Wednesday. A high-resolution photo can be found here.

FRANKFORT — The House Agriculture Committee advanced legislation Wednesday aimed at helping farmers more easily file and renew claims for crop and property damage caused by deer while also addressing overpopulation concerns across the state.

House Bill 142 focuses on simplifying the permit renewal process for landowners who experience repeated deer damage.

Rep. Michael Sarge Pollock, R-Campbellsville, said the legislation is intended to reduce delays and provide relief to farmers dealing with consistent losses.

“It expedites the process that farmers or a landowner can go through after damage due to deer,” Pollock said.

Currently, landowners must apply for a deer damage permit through the Kentucky Department of Fish and Wildlife Resources and provide documentation of crop or property destruction. Permits are issued for a limited time and require landowners to reapply and submit evidence of continued damage.

HB 142 would allow landowners who have documented damage for three consecutive years to immediately renew their permit, allowing a faster response to ongoing losses.

The bill additionally targets antlerless deer, which are the primary drivers of population growth. Under the legislation, the department of fish and wildlife would issue destruction permits in areas with an overpopulation of deer, allowing landowners to take antlerless deer outside normal hunting seasons.

Rep. Chad Aull, D-Lexington, asked how the state determines which areas qualify as overpopulated, and Pollock explained how these areas would be identified.

“The state is broken into zones by fish and wildlife by counties. Zone one and zone two are the over populated areas. However, in zones one, three and four, over population does not pertain to these particular areas, so for this bill they would determine the over populated areas,” he said.

Several lawmakers spoke in support of the bill, sharing personal experiences with deer-related losses.

Rep. Ryan Bivens, R-Hodgenville, a farmer, said deer have caused significant damage to his property.

“I think we lose close to six figures on the farm every year because of deer destruction – of not only crops but shed antlers damaging tires,” Bivens said.

Rep. Shawn McPherson, R-Scottsville, also spoke in support of the measure.

“There’s some mornings I can count 40-60 deer before I get a mile from the main road while driving,” McPherson said.

Rep. Walker Thomas, R-Hopkinsville, recalled his experience with a vehicle crash involving a deer.

“My last car was totaled from hitting a deer as I was driving the three hours up this way to Frankfort.” Thomas said.

Pollock explained the legislation could possibly work alongside efforts to provide venison to Kentuckians in need through organizations such as Feeding America and Hunters for the Hungry.

“That’s a passion that I have,” Pollock said. “They are all excited to know that this focus will provide extra protein, so we’re working through a process of what that could look like now.”

Rep. David Hale, R-Wellington, thanked Pollock and fish and wildlife officials for addressing earlier concerns.

“I’m very thankful you and fish and wildlife got together on issues that I had about the bill early on,” Hale said.

The bill passed 20-0 vote and now moves to the full House for consideration.

Committee passes provisional medical license bill

Sen. Stephen Meredith, R-Leitchfield, speaks Wednesday on Senate Bill 137 during a Senate Health Services Committee meeting. A high-resolution photo can be found here.

FRANKFORT — In a bid to lessen Kentucky’s medical doctor shortage, a bill that received approval Wednesday from the Senate Health Services Committee would eliminate a duplicative residency requirement for international doctors to practice in the state.

Senate Bill 137’s sponsor, Committee Chair Sen. Stephen Meredith, R-Leitchfield, said the shortage is pronounced in rural communities where 42% of Kentuckians live, but only 17% of the state’s primary care physicians reside.

“What we’re attempting to do is address a problem that is serious and will become more serious in the future. It’s projected by 2030 that we’re going to have a shortage of almost 3,000 physicians in the state of Kentucky,” he said.

Meredith said the bill isn’t a total solution to the problem, but a big step in the right direction. He said the state’s Medicaid spending has grown from $10 billion in 2017 to more than $20 billion today. A top priority is getting enough practitioners so that people have access to care, he said.

Joshua Reynolds, policy analyst for Cicero Action, said that under current law, Kentucky requires international physicians to complete residency in the United States even if they have completed a residency elsewhere. Senate Bill 137 would remove this duplicative requirement, he said.

Over the last five years, international medical graduates filled 237 – approximately 12% – of the state’s residency slots, Reynolds said.

“Many of these physicians did not need to repeat post graduate education, and allowing these internationally trained physicians who have already completed residency and worked for a number of years in the country of licensing, will allow them to immediately address the physician shortage in Kentucky and open up more of these slots for U.S. medical graduates,” he said.

Reynolds said there are many safeguards in the bill to ensure that access to care is increased and quality won’t be decreased.

Under SB 137, doctors would have to complete English proficiency requirements, be graduates of a foreign medical school and have completed a foreign residency program or alternatively, graduate from a U.S. medical school and have completed a foreign residency program.

They must also have at least five years of work experience as a physician fully licensed in their country of licensing and be in good standing with the licensing authority of that country, he said.

Reynolds said candidates need to be certified by the Educational Commission for Foreign Medical Graduates, pass exams required by the Kentucky board and have an employment offer from a sponsor.

Sen. Karen Berg, D-Louisville, who is a physician, said she has had positive experiences with physicians who were trained outside the United States.

“My experience has been very positive at the university, with foreign medical graduates, the majority of whom, that I know personally came from Germany – extremely well trained. They didn’t all do well in this country. I’ll be honest. I think out of the three that I worked with, two of them are no longer here,” she said.

Sen. Lindsey Tichenor, R-Smithfield, voted against the measure, saying she has concerns about the quality of training some physicians might have. She also said there’s the possibility of false licenses.

“I have some concerns with this bill based on a perspective that I bring. I lived for four years in a third-world developing country,” she said.

She said a national from the foreign country where she lived performed dental work on her, and she subsequently needed to have surgery in the United States.

Meredith said he worked with physicians from Pakistan, Canada, Lebanon, India and Iran while working as a hospital chief executive officer. He said the credentialing process is not simple.

“And this is radically different from just filling out a job application and wanting to go to work. Credentialing is a very structured process. And bear in mind that no provider wants to expose themself from a professional liability standpoint and they’re not going to take shortcuts. It doesn’t make sense to do that,” he said.

Sen. Keturah J. Herron, D-Louisville, voted for the measure and said it’s important to ensure something is built in for implicit bias training or diversity training at medical facilities.

Sen. Donald Douglas, R-Nicholasville, who is a physician, voted for the measure and voiced concern that physicians seeking to practice in Kentucky might not actually end up working in health care professional shortage areas.

“I think we need to allow the bigger picture in terms of more people in the general assembly to get an opportunity to get a bite of this apple and get comfortable with a bill such as this,” he said.

Senate Bill 137 now heads to the full Senate.

Senate moves forward on two bills related to status offenders

Sen. Stephen West, R-Paris, speaks Tuesday on Senate Bill 162 on the Senate floor. A high-resolution photo can be found here.

FRANKFORT — The Senate on Tuesday moved forward with two measures – Senate Bill 162 and Senate Bill 170 – related to student misconduct and ongoing efforts to divert status offenders from the criminal justice system.

Sen. Stephen West, R-Paris, said SB 162 addresses Family Accountability, Intervention and Response (FAIR) teams, which have been part of Kentucky’s efforts to assist juvenile offenders via diversion efforts – especially students who are habitually truant or engage in uncontrollable behavior at school.

The FAIR teams model was adopted by the Kentucky General Assembly in 2014 with the goal of bringing together representatives from the legal system, schools officials and others to help keep juvenile offenders on track and out of court.

West said the effort was well-intentioned and earned a lot of buy-in from stakeholders at the time.

“Fast forward to today, it has become clear that it is time for the FAIR teams part of the law to leave, to exit. It’s not working. The system is not currently working as intended,” he said.

West said the main issues with FAIR teams seem to be the length of time that the process takes and getting all the interested parties scheduled at the same time. He said juveniles are also waiting long periods of time to receive needed services.

“While they’re waiting for these services, they are back in school,” he said. “So, when they’re back in school, they’re causing the same types of problems for which they’re in diversion or they’re in front of the FAIR teams.”

Under the proposed changes, complaints filed against students who are beyond school control must be referred to the court-designated worker and to the county attorney for an initial decision about whether the youth will be referred for court action or remain with the court-designated worker (CDW) for diversion.

West said the bill ensures that any diversion agreement with the CDW includes a provision that the student attends school regularly and refrains from conduct that would lead to suspension or expulsion.

If the student is suspended or expelled, the CDW would consult with the county attorney, and if the county attorney determines that the child had adequate opportunity to engage in services, the youth will be considered to have failed diversion, he said.

West told other legislators that the juvenile justice process is complex and complicated with layers upon layers and different steps along the way.

“This bill simply removes one small part of that process before you get to the county attorney – the FAIR teams part of the process. There’s still a CDW there to handle the process, and they do have some wiggle room, some ability to maybe work with what otherwise would have been FAIR teams and try to consider those things. But it expedites the process and moves the cases along,” he said.

West said the most important thing the measure seeks concerning students who are beyond school control is to keep them out of the school setting.

“And so, it’s safer for students, and it’s safer for teachers in the school building,” he said.

SB 162 received Senate approval with a 30-7 vote.

SB 170 is sponsored by Sen. Brandon J. Storm, R-London, who said “the bill is grounded in one simple belief: That when a child struggles with attendance, the answer is early intervention and family engagement.”

The bill would establish the SOAR (Supporting Opportunities for Accountability and Restoration) Truancy Prevention pilot program in 10 school districts.

It would also strengthen diversion by making it a family diversion agreement, not just an agreement with the student. Also, the state Department of Education would be required to report data annually so the general assembly can evaluate if court involvement improves attendance, Storm said.

Other provisions of the bill would prohibit the secure detention of children under the age of 14 for status offenses. For children 14 and older, detention would be limited to seven days unless a judge makes written findings that continued detention is needed for public safety, Storm said.

“Let me be clear: The court retains authority and discretion to place a child in out-of-home setting when needed,” he said.

Storm recognized House Majority Whip Jason Nemes, R-Middletown, for working closely with him on the legislation and said the bill reflects a shared commitment across the chambers to improve early intervention and family engagement to address truancy and status offenses.

Sen. Keturah J. Herron, D-Louisville, said she’s a former court-designated worker and court-designated specialist who worked in the juvenile justice system for years. She said FAIR teams worked well.

She said the juvenile justice system doesn’t always have the support it needs and the general assembly should keep finances at the forefront to keep programs going – this includes prevention and intervention.

“If it doesn’t have a financial tag, I think we need to reconsider what we’re doing,” she said.

SB 170 was unanimously advanced by the Senate.

House votes to opt-in to federal educational freedom tax credit

Rep. Kimberly Poore Moser, R-Taylor Mill, speaks on House Bill 1 on the House floor on Tuesday. The legislation would pave the way for Kentucky to opt into a federal educational funding program. A high-res version is available here.

FRANKFORT — Kentucky may soon be eligible for a new federal educational tax credit program.

The Kentucky House of Representatives voted 79-17 with one abstention on House Bill 1 on Tuesday. The legislation would pave the way for Kentucky to opt into an educational funding program established in House Resolution 1 – or the One Big Beautiful Bill Act – in Congress last year.

Rep. Kimberly Poore Moser, R-Taylor Mill, is the primary sponsor of the legislation. She said the bill would ensure Kentuckians don’t miss out on a federally-funded opportunity.

“This measure would provide a significant tool for public schools to harness a federal tax credit to assist families and children access school resources,” Moser said. “It affirms our commitment to expanding educational opportunities and improving student outcomes.”

Under HB 1, Kentucky would be eligible to participate in the qualified elementary and secondary education scholarship federal tax credit program for individuals who make a qualifying contribution to a scholarship granting organization, or SGO.

The legislation would grant Kentucky’s Secretary of State the authority to opt-in to the program on behalf of the commonwealth and oversee Kentucky’s participation. Under federal law, qualified participants could receive up to a $1,700 tax credit on donations to an SGO annually beginning in 2027.

On the House floor, Moser said if Kentucky does not choose to opt-in, schools in other states will benefit from money that could be going to a local SGO instead.

“Under this model, public schools could establish their own independent scholarship granting organizations to collect donations, just as they do with other nonprofits like PTO or athletic boosters to administer SGO funds,” Moser said.

SGO funds cannot be used for tuition, but SGO dollars could fund other scholarship opportunities for students in public, private and homeschool settings. The scholarships can be used for fees, tutoring, technology, transportation, special needs programs, instructional materials, school supplies and more, Moser said.

“(HR 1) sets clear guidelines for how the funds are used – at least 90% of the contributions must be awarded as scholarships to students,” Moser said. “This really prioritizes supporting middle- and low-income households.”

Moser said HB 1 is constitutional under state law since the legislation does not allocate any state public dollars to fund SGO accounts.

If passed, Kentucky would join 27 other states that have opted in to the program so far.

Rep. T.J. Roberts, R-Burlington, is a primary co-sponsor of the legislation. He said HB 1 is about the average Kentuckian, and he doesn’t want Kentucky students to miss out on this opportunity.

“There are students with special needs, there are students who don’t have the same learning style as myself – House Bill 1 looks out for them and puts the Kentucky students first and ensures that we are capable of providing the best opportunities for every student regardless of their income,” he said.

The House debated HB 1 for an hour Tuesday, with several lawmakers sharing concerns the legislation will ultimately lead to less funding for public education.

Rep. Mary Lou Marzian, D-Louisville, said she worries opting in to the federal program will lead to public dollars being used to fund private schools more so than public schools.

“The fear that this is the road to vouchers and charter (schools) is really a slap in the face to our teachers, our classified staff, who often work just for a paycheck for their health insurance,” she said. “… I would love to take a step back and see what the full cost of this could be and how much money it’s going to put in the pockets of the very wealthy.”

House Speaker Pro Tempore David Meade, R-Stanford, said HB 1 is not about private schools.

“This is a chance to get more funding in public education” he said, adding he wants his public schools in his district to benefit from this opportunity.

Other lawmakers said they were also voting for HB 1 for public schools in their communities.

Rep. Chris Fugate, R-Chavies, said his Eastern Kentucky district is home to one of the poorest counties in the country: Owsley County. He said he plans to help Owsley County start an SGO if HB 1 becomes law.

“My understanding is this is to help the poorest of the poor,” Fugate said. “There are no big private schools in Owsley County.”

In explaining her vote on HB 1, Rep. Tina Bojanowski, D-Louisville, said she struggled to decide whether to vote yes or no on the legislation. She ultimately decided to vote yes with the commitment to help public schools in her district as well.

“It’s a really, really hard vote for me,” she said. “But I believe in my heart and soul that this will help public education students. So I’m going to stick with the yes, because I’m going to do everything that I can to ensure that we have scholarship granting organizations that help public education students and students with disabilities.”

HB 1 is now before the Senate for consideration.

Committee advances bill requiring child abuse training for animal control officers

The House Local Government Committee voted Tuesday to advance House Bill 246 in the 2026 legislative session

FRANKFORT — — The House Local Government Committee advanced legislation Tuesday that would require animal control officers to complete training to help recognize signs of child abuse and neglect.

House Bill 246, sponsored by Rep. Susan Witten, R-Louisville, would mandate training for animal control officers to identify physical, sexual, and emotional abuse, as well as neglect. The bill is intended to strengthen Kentucky’s child safety network by equipping more workers to recognize warning signs.

Witten said the legislation is a preventative measure designed to protect vulnerable children.

“This is a simple bill meant to protect children and save lives,” Witten said. “Animal control officers are often the first to witness warning signs like domestic child abuse in the household.”

The legislation is known as “Kyan’s Law,” named after a 10-year-old boy who was killed by his mother. According to testimony, animal control officers had visited the home 24 times in the 18 months leading up to his death.

The training would be available both in person or online and would cover how to recognize and properly report suspected abuse.

Kiera Dunk, a junior at North Oldham High School who worked with Witten on the bill, testified about the connection between animal abuse and child abuse.

She shared research showing that individuals who abuse animals are more likely to abuse children. Dunk also explained that animal control officers are an underutilized resource in identifying abuse because they often encounter young children who are not yet in school and may not interact with mandated reporters such as teachers.

Jill Seyfred, executive director of Prevent Child Abuse Kentucky, explained how the training would work and how data would be recorded to better understand trends in child abuse reporting.

“The training will be housed on our website free of charge,” she said. “We will keep track of individuals and counties who are participating so we can report back on the impact the training is having.”

Rep. Sarah Stalker, D-Louisville, asked whether the training would be required annually or just once. Witten said the bill currently requires only a single training.

Rep. Beverly Chester-Burton, D-Shively, asked whether other states had adopted similar measures.

Dunk said many states have implemented comparable training requirements, while Seyfred added that others are watching Kentucky’s approach closely.

“There are also a lot of states who have not adopted this but are showing lots of interest in the effectiveness as well as how we are going to implement it,” Seyfred said.

Several lawmakers also praised Dunk for her advocacy and work bringing attention to the issue at a young age.

House Bill 246 passed 19-0 and now moves to the full House for consideration.

Imagination Library resolution advances

Senate Minority Whip Cassie Chambers Armstrong, D-Louisville, testifies Tuesday on Senate Joint Resolution 54 in support of Dolly Parton’s Imagination Library during a Senate Families and Children Committee meeting. A high-resolution photo can be found here.

FRANKFORT — — Reading can open doors for young people that are otherwise shut, and with this mindset, legislators on Tuesday advanced a Senate joint resolution in support of Dolly Parton’s Imagination Library.